- #Noi in real estate means how to#

- #Noi in real estate means full#

- #Noi in real estate means professional#

#Noi in real estate means professional#

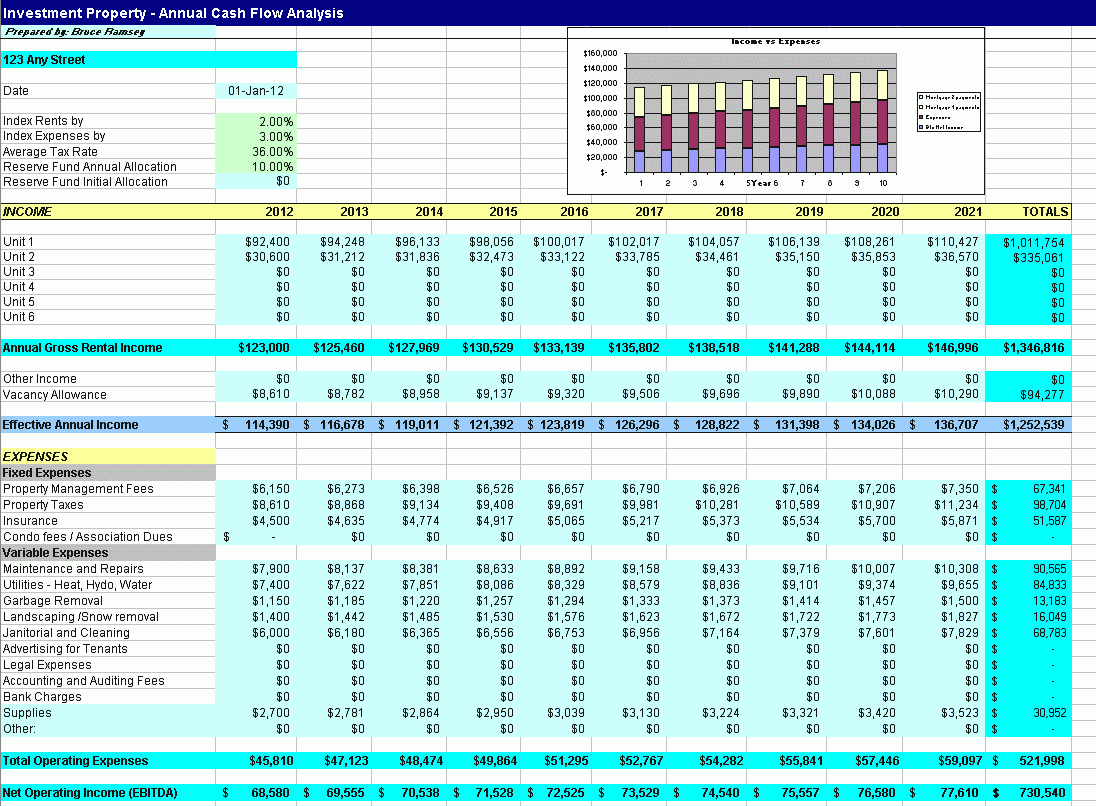

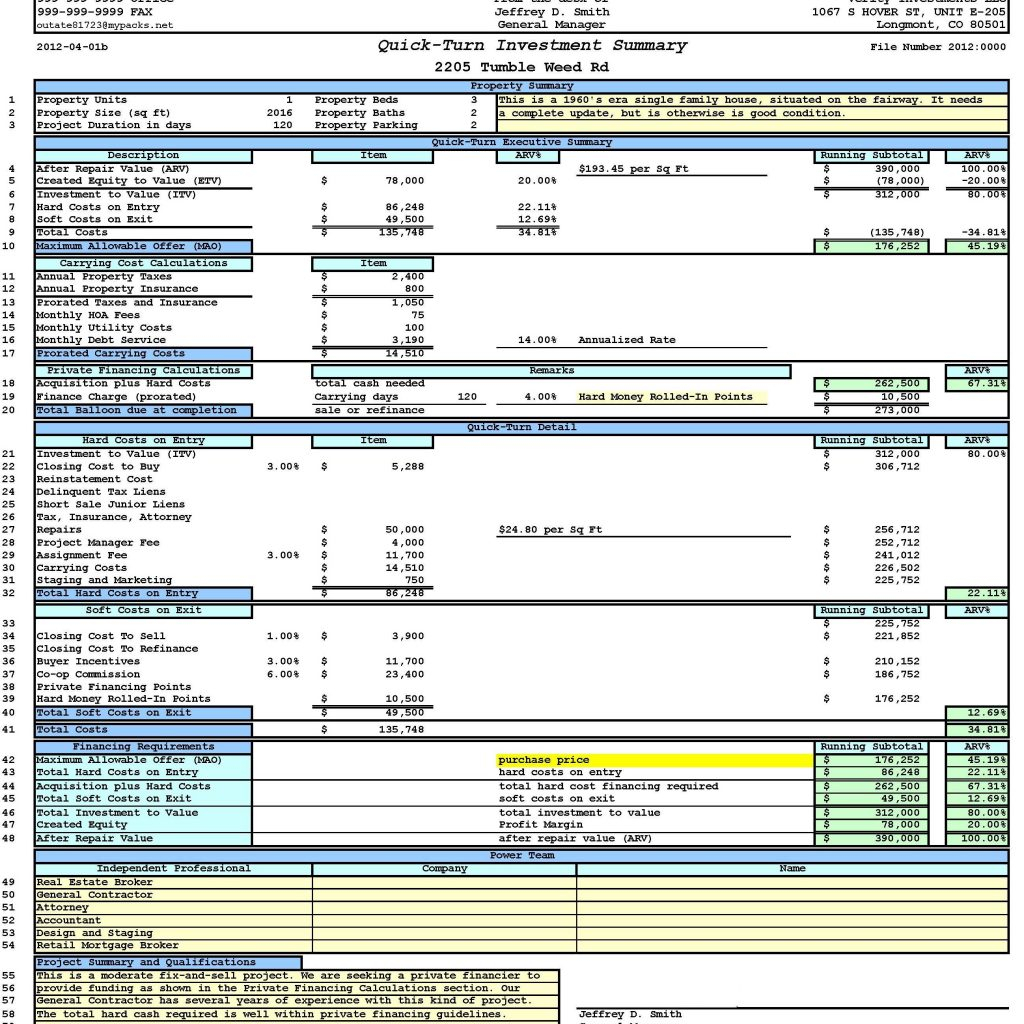

It is the most practical and common pricing standard used in the industry.Īny real estate investor, or investment real estate professional must have a through understanding of cap rates to be proficient enough to participate in commercial real estate investment markets. The cap rate is used to set prices, compare real estate investments, and analyze commercial real estate markets. In investment real estate, the cap rate is the standard used in investment real estate practice to understand pricing and gauge expectations of returns in commercial real estate markets.

#Noi in real estate means full#

This will give you an overview of how the property performs and how long it will take to return the full investment when purchased in full with cash.Why Is The Capitalization Rate Important? Use it as a quick snapshot to give you a pulse of the property before taking a deeper dive into the rent roll and the last 12 months of expenses. Keep in mind, cap rates are strongly influenced based upon a property’s geographic location and the economic cycle.

Would you prefer a high monthly cash flow or long-term appreciation? There is typically a trade-off here. When comparing cap rates, be sure to only make parallels to the cap rates of surrounding areas, because every city is different.įirst, you must decide which type of return on investment you are searching for. A 6% cap rate in Los Angeles is a completely different property than a 6% cap rate in a more rural town like Portsmouth, Virginia. To clarify, this largely varies when you change the geographic location. A high cap rate (8% or highter) is usually found in a very low-income area with little to no amenities, high crime rates, poor school systems, outdated construction and typically C- or D-class properties. A medium cap rate (5.5%–8%) is usually found in a lower-income area with average amenities, slightly higher crime rates, average school systems, older construction and typically B- or C-class properties.

A low cap rate (3%–5.5%) is likely to be found in a nicer area with better amenities, lower crime rates, better school systems, newer construction and typically A- or B-class properties.

#Noi in real estate means how to#

The next most important analysis when looking at cap rates is knowing how to compare them and what gut instinct you should feel.

House values are based on “comps,” like-kind and quality nearby houses which have recently sold, whereas apartments are valued based on their profitability with respect to their investment (NOI divided by purchase price) - or in other words, the cap rate. Be mindful that this can deviate depending upon the economic cycle, fluctuations in NOI, property value, etc.Īnother key concept to remember is that apartment complexes are not evaluated like houses. Cap rate is almost like an investor’s crystal ball to predict the upcoming years. When analyzing an investment, the cap rate is a vital metric because it provides a portion of insight into the future. For example, if the NOI of an apartment complex is $800,000 and the purchase price is $10 million, then the cap rate is $800,000/$10,000,000 which equals 8%.ĭepending on your area, 8% could be good, but in other areas, it might be unrealistic. A cap rate is simply the net operating income (NOI) of a property divided by its purchase price.

0 kommentar(er)

0 kommentar(er)